Introduction:

In the rapidly evolving landscape of business, effective human resource management is imperative for organizational success. One of the key components of this management is payroll processing. As businesses in India strive for efficiency, accuracy, and compliance in payroll management, the demand for the Best HR payroll software in India has witnessed a significant surge. In this article, we delve into the essential features, advantages, and considerations for choosing the top payroll software in India, shedding light on how it can transform HR processes.

The Evolution of Payroll Software in India:

Gone are the days of manual payroll processing, which was not only time-consuming but also prone to errors. Today, with the advent of advanced technology, businesses are increasingly turning to automated payroll solutions to streamline their processes. Payroll software in India has witnessed a remarkable evolution, catering to the diverse needs of organizations, from small enterprises to large corporations.

Key Features of the Best HR Payroll Software in India:

Comprehensive Payroll Processing:

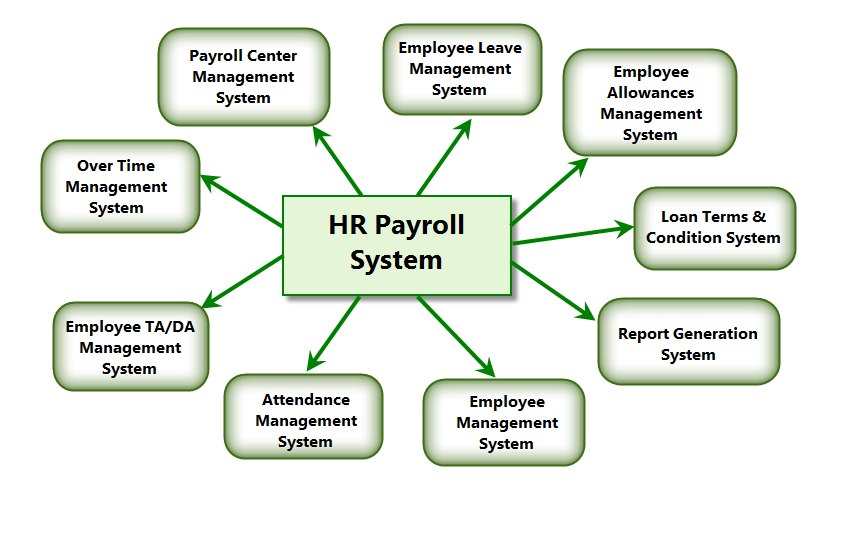

The best HR payroll software in India goes beyond basic salary calculations. It encompasses a wide range of payroll functions, including tax calculations, statutory compliance, and reimbursement management. This ensures that businesses can handle complex payroll structures seamlessly.

Tax Compliance and Reporting:

India’s taxation system is intricate, and non-compliance can lead to severe consequences. Top-notch payroll software is equipped with features that automatically calculate taxes, generate statutory reports, and keep businesses compliant with the latest tax regulations.

Employee Self-Service Portals:

Empowering employees to access their payroll information, download payslips, and manage personal details fosters transparency and reduces the burden on HR departments. The best payroll software in India often includes user-friendly employee self-service portals.

Integration Capabilities:

Seamless integration with other HR and accounting systems is crucial for a holistic approach to workforce management. The best payroll software ensures data synchronization across various platforms, minimizing errors and enhancing overall efficiency.

Attendance and Leave Management:

Integrating attendance and leave management features with payroll ensures accurate calculations based on attendance records. This helps in reducing manual errors and ensures that employees are compensated accurately for their work.

Advantages of Implementing Payroll Software in India:

Time and Cost Savings:

Automating payroll processes significantly reduces the time and effort required for manual calculations. This translates into cost savings for businesses, allowing HR professionals to focus on strategic initiatives rather than routine administrative tasks.

Accuracy and Error Reduction:

Payroll software eliminates the risk of human errors associated with manual calculations. Automated systems ensure accurate and error-free payroll processing, reducing the likelihood of disputes and enhancing overall employee satisfaction.

Statutory Compliance:

Staying compliant with ever-changing labor laws and taxation regulations in India is a complex task. The best HR payroll software in India is designed to stay updated with the latest statutory requirements, minimizing legal risks for businesses.

Enhanced Data Security:

Payroll data is sensitive and requires robust security measures. Payroll software employs encryption and other security protocols to safeguard confidential employee information, providing businesses with peace of mind regarding data protection.

Considerations for Choosing the Right Payroll Software in India:

Scalability:

As businesses grow, their payroll needs evolve. Choosing scalable payroll software ensures that the system can adapt to the changing requirements of a growing organization.

User-Friendly Interface:

A user-friendly interface is crucial for the successful implementation of payroll software. Intuitive navigation and clear functionalities contribute to seamless adoption by HR professionals and employees alike.

Customization Options:

Every business has unique payroll requirements. The ability to customize the software to accommodate specific needs ensures that it aligns with the organization’s structure and processes.

Vendor Support and Training:

Ongoing support and training from the software vendor are essential for successful implementation and troubleshooting. Opting for a vendor with a robust support system enhances the overall user experience.

The Future of Payroll Software in India:

As technology continues to advance, the future of payroll software in India looks promising, with the integration of artificial intelligence (AI) and machine learning (ML). These innovations have the potential to further automate and optimize payroll processes, predicting patterns and identifying discrepancies before they become issues. This not only enhances the accuracy of payroll calculations but also allows HR professionals to focus on strategic decision-making rather than routine tasks.

Another aspect shaping the future of payroll software is the rise of cloud-based solutions. Cloud-based payroll software offers unparalleled flexibility and accessibility, allowing businesses to manage payroll operations from anywhere with an internet connection. This is particularly advantageous in a globalized business environment, where remote work and international operations are increasingly common.

Payroll Software in India: A Competitive Landscape

The increasing demand for the best HR payroll software in India has led to a competitive landscape with numerous vendors offering varied solutions. From established global players to emerging local providers, businesses have a plethora of options to choose from. When selecting payroll software, organizations need to conduct a thorough evaluation of features, pricing, and vendor reputation to ensure they align with the unique requirements of their business.

Understanding that payroll software is not a one-size-fits-all solution, some providers offer industry-specific customization. This is particularly beneficial for businesses operating in sectors with unique payroll challenges and requirements, such as manufacturing, healthcare, or IT services.

Realizing the Full Potential: Employee Engagement and Beyond

While payroll software primarily focuses on accurate salary calculations and compliance, its impact extends beyond the realm of HR and finance. Employee engagement is a critical aspect that should not be overlooked. The best HR payroll software in India includes features that promote employee engagement, such as interactive dashboards, personalized communication, and recognition programs.

Moreover, integrating payroll software with other HR modules, such as performance management and talent acquisition, creates a unified ecosystem for managing the entire employee lifecycle. This not only streamlines processes but also provides valuable insights for strategic workforce planning.

Conclusion:

The adoption of the best HR payroll software in India is a strategic move for businesses aiming to enhance their efficiency, accuracy, and compliance in payroll management. With features like comprehensive payroll processing, tax compliance, employee self-service portals, and integration capabilities, these software solutions are reshaping the way organizations handle their workforce management.

As businesses continue to prioritize streamlined processes and data accuracy, payroll software in India is becoming an indispensable tool for HR professionals. By considering factors such as scalability, user-friendliness, customization options, and vendor support, organizations can make informed decisions to choose the right payroll software that aligns with their unique needs and contributes to their long-term success in the dynamic Indian business landscape.