A bad credit score may turn your financial freedom into financial obligations. You may wonder how to keep up with the competition that manages an impactful company credit report in India. Besides, lenders may lose interest in lending you funds, and your borrowing power steeps low. A low company credit report is unhealthy for your business as it not only impacts your credit score but provides information about your financial habits to the investors.

That?s why you should keep a check on your credit score for company and improve your financial habits, including paying off debts on time. You can check your company?s credit score through credit reporting agencies like CreditQ to ensure your business is heading in the right direction.

If you?re dealing with a bad credit score, here?s a blog to help you recover from it so that you are no more subjected to negative reviews and losing out on important business prospects.

Keep your credit utilization ratio low

The first thing to improve your credit score for company is to keep a check on your credit utilization ratio. For instance, if you have a credit limit of INR 50,000 and you?ve used only INR25,000, it will reflect as a positive step towards improving your score. If your credit utilization ratio is low, you?ll have more financial freedom to spend wisely. Besides, you keep your business away from unwanted debt. A low percentage can help you attract big prospects.

Pay your dues on time

It?ll be said time and again that delayed payments impact your company credit report in India negatively. If you miss your payments regularly and do not pay off your dues under the estimated period, you may lose out on a good credit score. Whereas, if you regularize your payment every month, lenders will be happy to work with you again.

Borrows funds only when needed

For a new business, invest in the littlest of things that seem relevant. However, it?s not the case! When you borrow unnecessary funds and do not utilize them properly, it becomes a financial burden on you. Not only do you pay the extra debt, but you also lose out on your financial credibility. You must maintain a healthy company credit report in India to mark your business growth.

Check your company credit score regularly

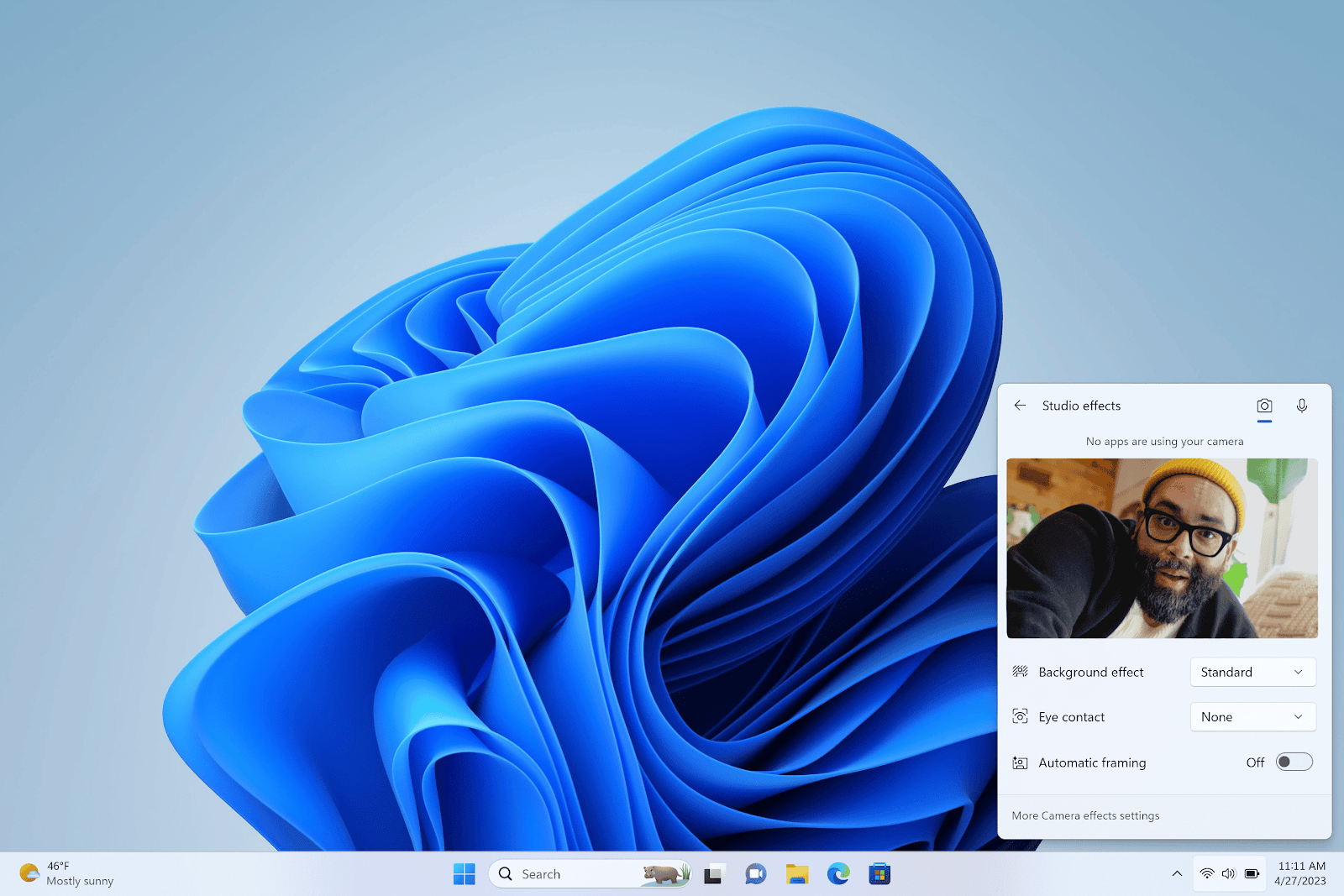

Your colleagues may have suggested the same! Well, this is a reminder to check your credit score regularly and analyze where do you lack and how can you improve upon a bad credit score. Many credit reporting bureaus like CIBIL, Experian, and CreditQ provides business credit score. You can stick to any one platform and use it to your benefit.

For any business, a good business credit report and score are important as it provides you borrowing power and financial freedom to work with smart investors and shake hands with trusted lenders.

However, you must understand that there are different kinds of lenders in the market. Some may rely on your business credit information to work with you, while others may consider several different factors to analyze if you meet their business standards. With that said, it?s important to regularly review your business credit score so that your financial habits can lead you to a prosperous business.

CreditQ lets you check your credit information report and scores, prepared through a unique credit reporting information diagram. You can also list out your defaulters to gain an advantage of payment settlement.?