Payment gateway solutions are in demand to make your business surge to a next scale. You can consider several features while going for an accurate payment gateway. Merchants desire to get the premium solutions related to deals. Thus in these circumstances, a gateway allows a profitable solution to your business. Various aspects are considered before you go to the merchant account processor. Industrialists should attempt to study well about the solution provider and then approach them. Thus you can go for a High-Risk Merchant Account solution.

Seek accurate payment processing

Accurate processing functions as a reliable device that makes your transactions secure and get the best out of it.

Integrated website solution

With an integrated form, you can augment your business. With this technique, it becomes easy for you as you get your payouts on time. All the facts of your corporate send to your site without any disturbance. The API calls make simple payments. With sophisticated planning, your website attracts thousands of customers daily.

Escrow procedure for industries

Escrow with a safe procedure opted by merchants and its works as an intermediate way-out between the corporate and the payment gateway provider. Here we perceive that this mode of processing is suitable for both customers and the merchant.

Select the right stuff

Being a merchant, the priority lies for you is to prefer the right product along with payment gateway way-out. A transaction with no interference makes your payment secure. It is vital to incorporate your website with a payment gateway. Just look for a specialist team that can provide you premium facility.

The sound transaction with security

Running an online business needs sound deal with security and if you are a big business owner, you can run your business effectively. But if you are a small business owner, you must go for safe payment alternatives. Your patrons will hope that you must have a secure site for payment processing.

Consider Fees for payment gateway

A fee is generally based on the sort of deal a business conducts. It depends on business sales, the stability of income, transaction speed, and what kind of market you are in. Whether you are serving the local market or international market, a specific fee is considered. Few merchant account processors also need to set up charges as well.

Effective deals are assured

Effective deal plays a leading role for industries and a large group of customers will not purchase if they have to register for an account. Therefore payment gateway will assist you to evade unwanted forms requirements for simple payment.

Easy checkout while purchasing

World marketers assume e-commerce sales have risen by fifteen percent in the last two years. Payment gateway options are assessed, you must be certain that there must be a working checkout. This would be receptive to diverse mobiles.?

Manifold features you can select

Payment gateway suppliers provide numerous aspects according to your industry. If you desire to make your business touch the foreign land, you must seek a global payment gateway, multiple currency alternatives, etc. on basis of nations. Payment gateway impacts industries. Just observe whether your payment gateway assists electronic payments, invoicing, etc.

Effortless payment gateway incorporation

Numerous payment gateways provide complete guidelines to merchants to incorporate to pedestals such as Magento, WooCommerce, and several others. Go for a payment gateway appropriate for your clients to make payouts and they can choose process according to their preference.

Business account

Merchants must have a business account to obtain money via a payment gateway. A merchant account is employed while customers make payments to sellers online. The fund is transferred temporarily to an individual seller account.

Repeated invoice

?Recurring billing makes you establish an automatic billing series meant for your customers. It is vital for companies with monthly payout plans.?

Besides, non-profits found that recurring billing is beneficial as it is conducive for industries to go for fund collection from contributors without interference.

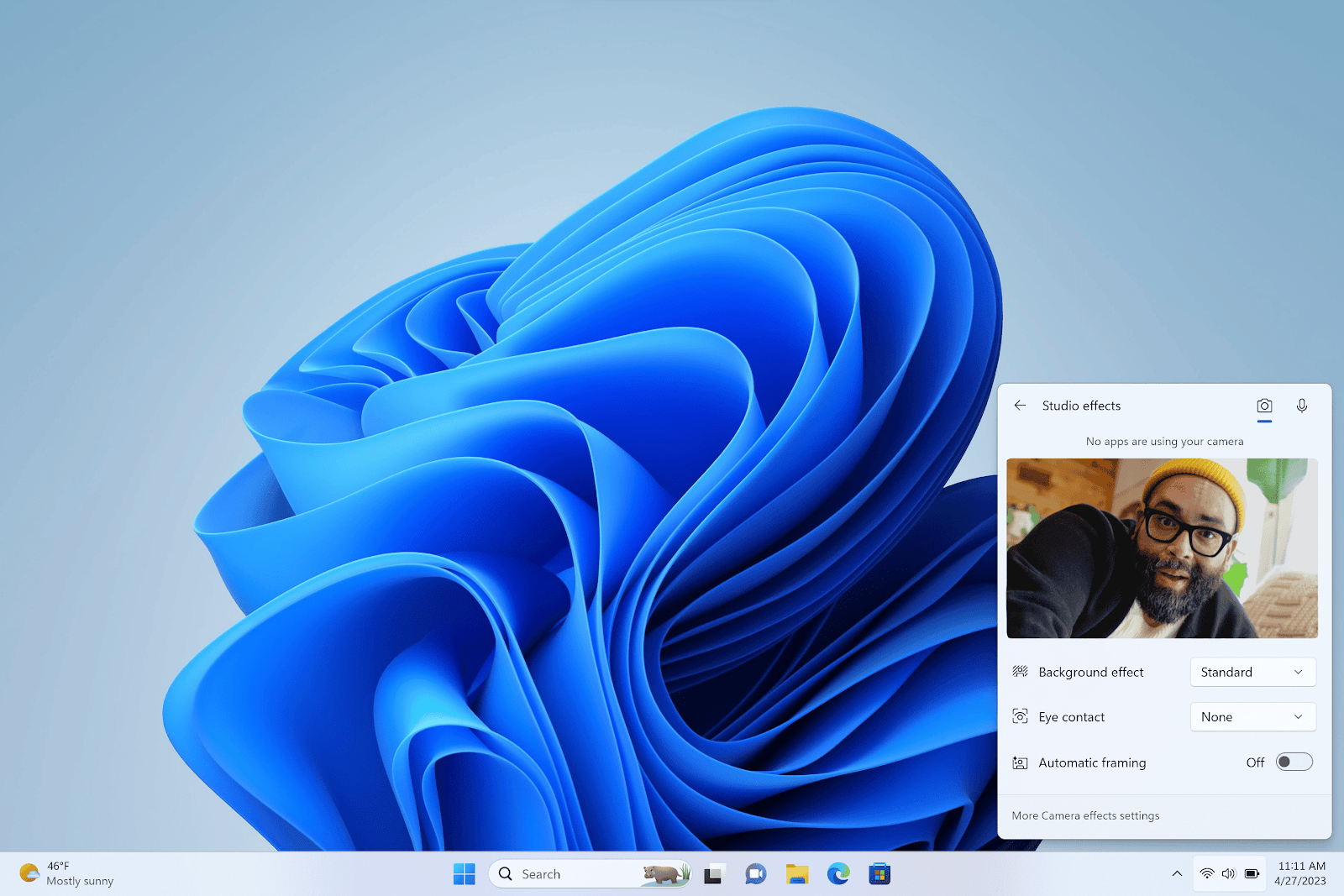

Processing of payment via mobile

Mobile payments are in demand nowadays. With mobiles, the customers find it easy to transfer the funds via branded applications. Besides, this offers security to your payments. We see that emergence of mobile wallets has been rapidly increased considerably and this has greatly influenced the market.

Customer support available

Numerous payment gateway processors restrict their assistance to tickets or through emails. Thus an operator needs to fix up the problem. Verify whether the payment processor offers technical support or any other way-out to clients.

Conclusion

Choosing the preferred payment gateway is conducive for industries and can consider various options while going for payment gateway services. In these circumstances, look for payment gateway as a platform for business enhancement. Select the right solution provider for your business and look for other way-outs. Being a merchant, you can look for various services to enhance the deals. Whether you are seeking a high-risk account, high-risk gateway process, multiple currency options, international payment gateway facility, you can safeguard your business. With the right payment processor, it is easy for your patrons to transfer the amount from their account to yours without any discomfort. Thus High-Risk Payment Gateway solutions offer safe enhancement in business.