For millions of people who feel the occasional demand for some fast cash, payday loans in canada are blessing. They are easy to have and provide only smaller amounts, which make them amounts, which make them accurate for temporary financial emergencies.

These loans will not need a security deposit. People will simply give the lending venture. People will simply give the lending venture with postdated checks that they will encash when the date of their loan payment arrives. The loan payment is then effectively decreased from their monthly income.

What the demands for pay day loans?

- Pay day loans are one of the simplest loans to get. Some of its needs are simple: the lender must be at least 18 years old at the time of the loan; he or she must be trained full time with an effective monthly income. They have a checking account.

- Pay day loans don?t need anyone to submit their credit report nor will their credit background be checked. Pay day loans will help a great deal. Anyone can even go for and have approval within a short time. They are within in 24-hour duration.

- This will make pay day loans suitable for times when they have required for cash.

However, they are of unsecured loans, pay day loans come with higher interest proportions. They are also shorter in duration, with some loans demanding repayment within a single week.

- Most pay day loans are given for a two-weeks. This is where a lot of people have issues . The rollover will involve an additional fee that they will have to pay for not being capable to fulfill their obligation on time. This is usually a fixed proportion but over time, this will increase the interest rate of the loan amount.

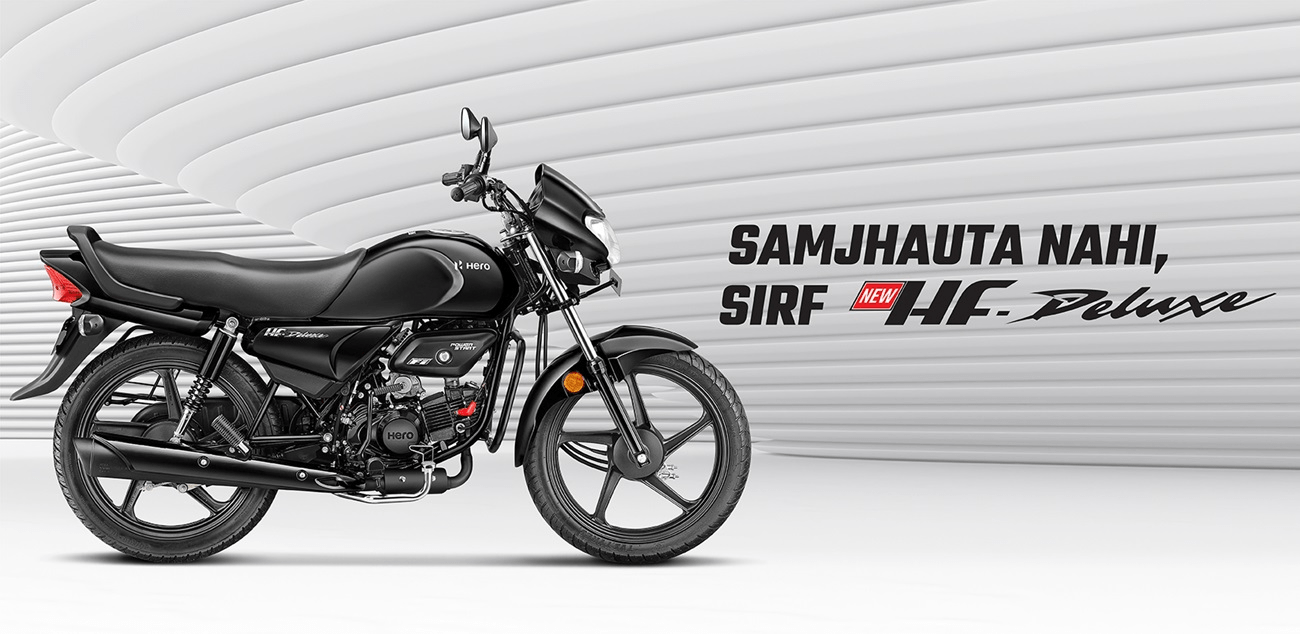

- Anyone requiring loans to consolidate their credit cards, home improvements or having a car, they were needed to get dressed up and head directly to the bag. But now if anyone is deciding to apply for a loan through portals, then they must look for the best personal online lender.

- The lender that has the best rates for their clients, by doing this they will not face any hurdle of repaying their loan. Most of the online lenders are offering online credit to assure that they are accessible to everyone. Therefore while deciding to apply for online loans; the following are the attributes anyone will get:

Ease:

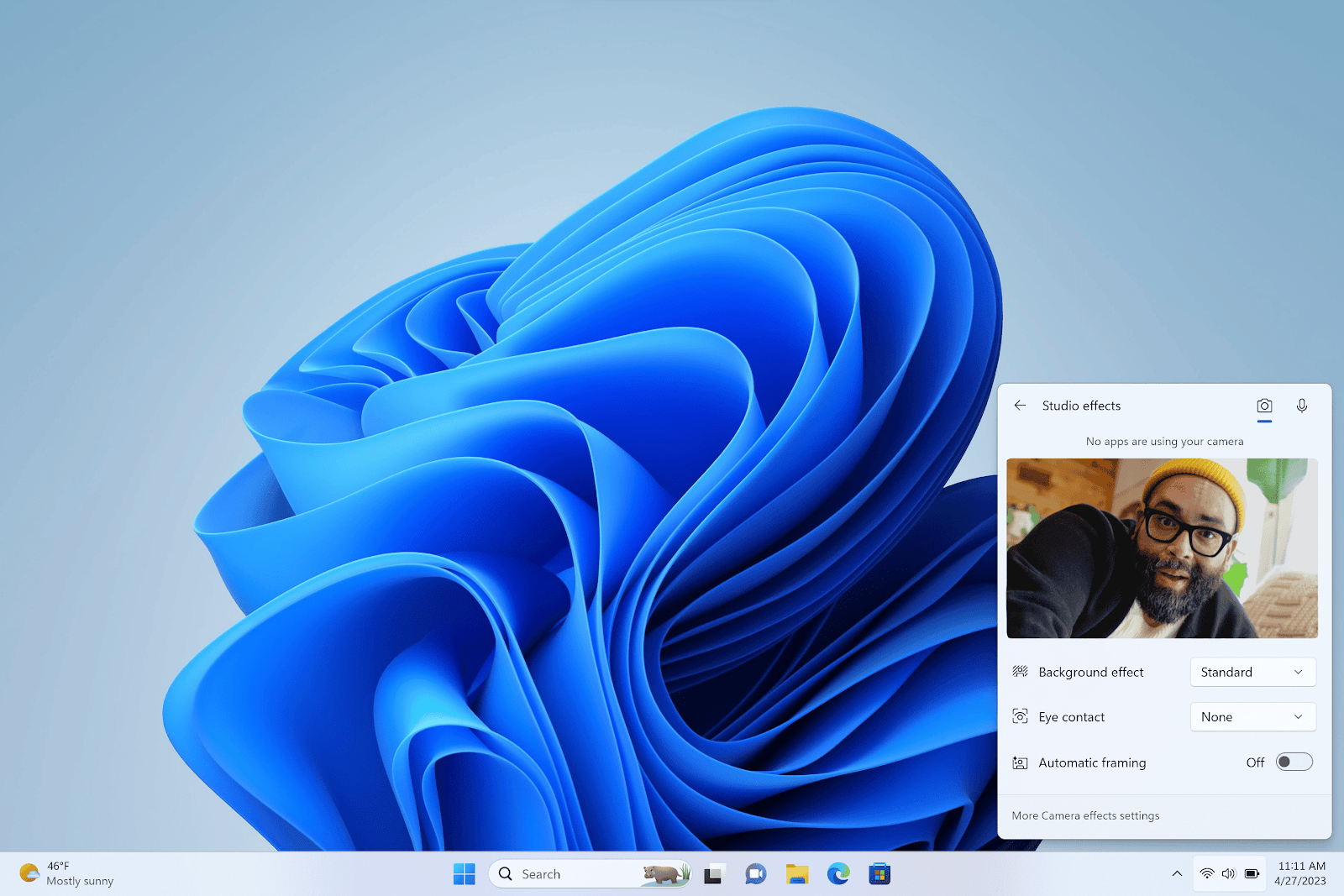

One of the primary factors why most people are attracted to online loans is due to ease. When anyone applying for online loans, they can easily do it from the comfort of their place, it can be office or home. With their mobile phone, they can fill the online forms and get checked immediately.

When they are taking for their loan, all of their dealings with their lender will arise online. They don?t need to go to the bank to fulfill with their lender. After they have filled their forms, wait for their loan in their bank account.

Lower Rates:

Most of the online loan lenders give lower fees and rates as they don?t have added expense of physical offices. Also, the interest proportions are fixed. They don?t need to worry about fluctuating charges.

Saves Time:

Whenever they are financially not stable, one of the best options they are probed to consider is online loans. With this variety of loans, they are only needed to fill little content unlike the conventional ways of applying for loans. Technology has altered the lifestyle of various people. Most people can now use online loans from their bags.

Online loans are indeed motivating, but for some, this can be disturbing. A broker can support a debtor decide on what will be the most appropriate and interest rate-friendly for the client. A broker can also recommend different loan providers who have a good status in online loans

The article is all about how to apply for a loan online. Anyone can easily loan applications all the time. Users can track their loan processing and after that people can use that to handle their loan online. Customers can fetch all the content like outstanding balance, interest, tenure, and much more.

.